Audit your travel expenses

Manage and optimise your travel expenses

Keep track of your T&E expenses

Our travel expense control software allows you to review, validate and analyse all travel expenses of our clients’ employees to ensure compliance with the formal requirements of tax legislation to ensure that they are deductible from the company’s income tax. This is over and above to optimising the subsequent VAT recovery.

As part of the documentation review, we detect errors, duplicates, irregular receipts and non-compliance with company policies. This service can be integrated with any expense management tool on the market and is 100% complementary.

Benefits of auditing your expenses

Compliance with your corporate policies

We monitor compliance with your corporate policy, while detecting irregularities and duplicates in your expense claims to avoid errors and inefficiencies in your accounting.

Eliminate tax risk

Our team of tax experts will review your expenses to ensure that they comply with the formal and deductibility requirements of the legislation of each country in which you operate.

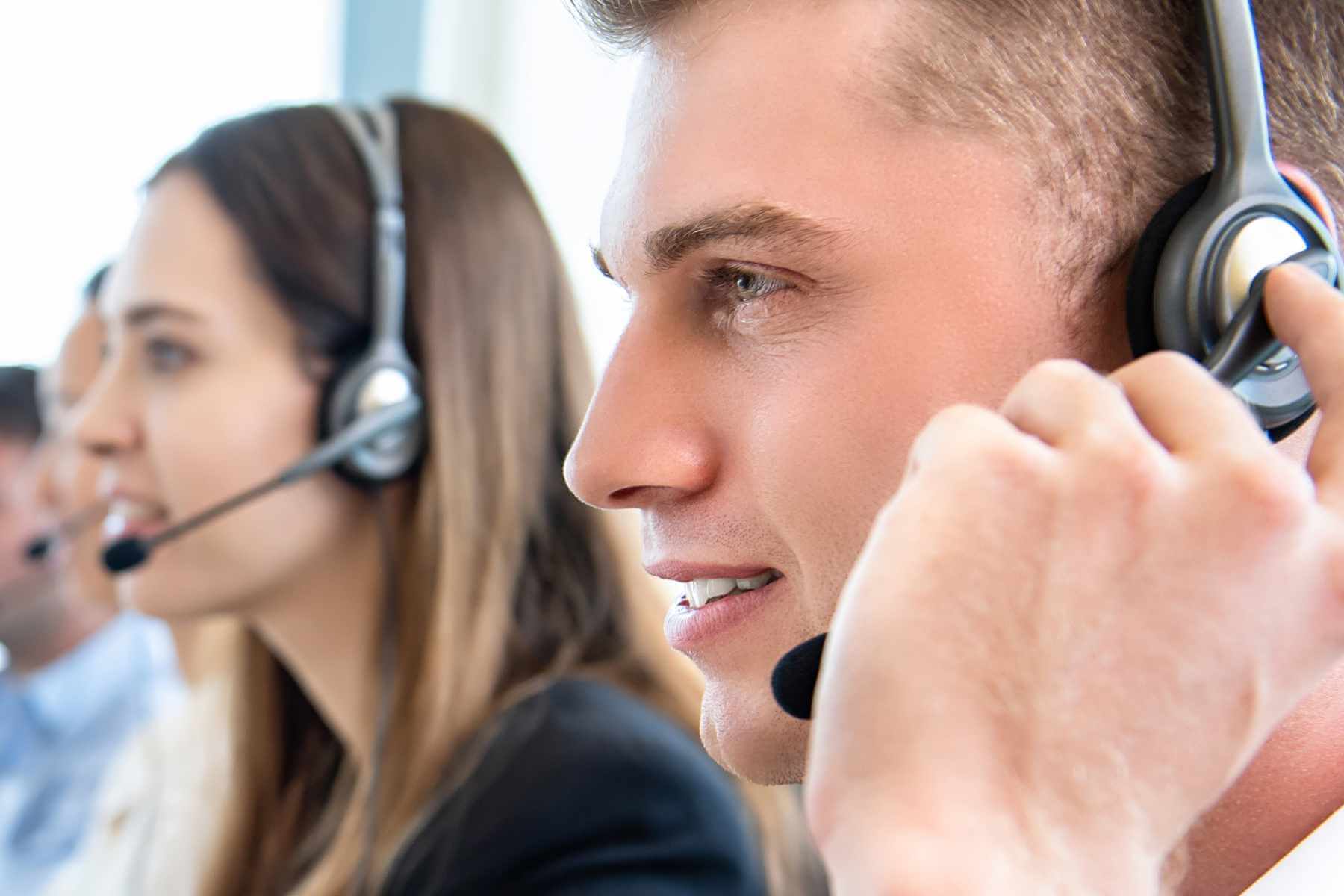

Expert expense management supervision

Your expenses will always be thoroughly reviewed by a team of experienced professionals – we don’t rely solely on automated systems! This way we avoid errors and improve the response to unusual situations.

Full visibility of the review process

You will have access to the Audit website, so that you can consult and review in detail each of the settlements, documents and possible incidents contained in them.

Common incidents in expense settlements

Failure to comply with AEAT requirements

Duplication

Over- or under-settlement

Incorrect foreign exchange

Illegible documents

Unqualified expenses

Irregularities and manipulation

Do you have any questions?

If you have any questions, please do not hesitate to contact us.